Project-2

ST 558 Project 2

Project maintained by kafrazi2 Hosted on GitHub Pages — Theme by mattgraham

ST 558 Project 2

Kaylee Frazier and Rebecca Voelker 10/31/2021

- Introduction

- Exploratory Data Analysis (EDA)

- Create New Variables for EDA

- Graphical summary of shares by Content Length and Weekday vs. Weekend

- Graphical and Numerical summary of shares by Weekday vs. Weekend

- Graphical and Numerical summary of shares by Title Polarity and Length

- Numerical summary of shares by day_of_the_week

- Bar chart of shares by day of the week

- Summary table of shares by number of images

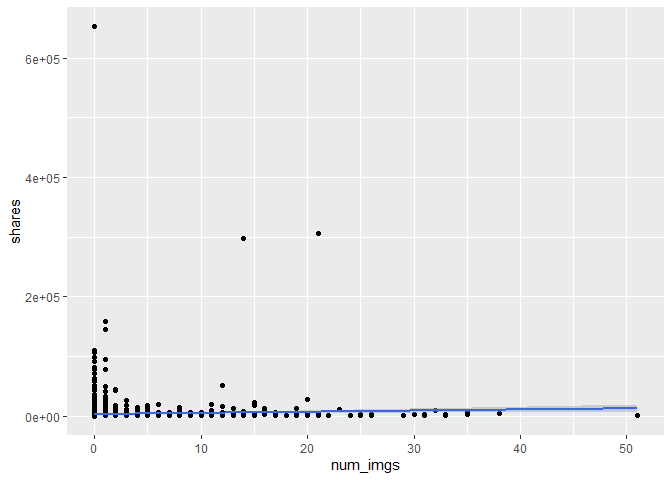

- Scatter plot of the image number and shares.

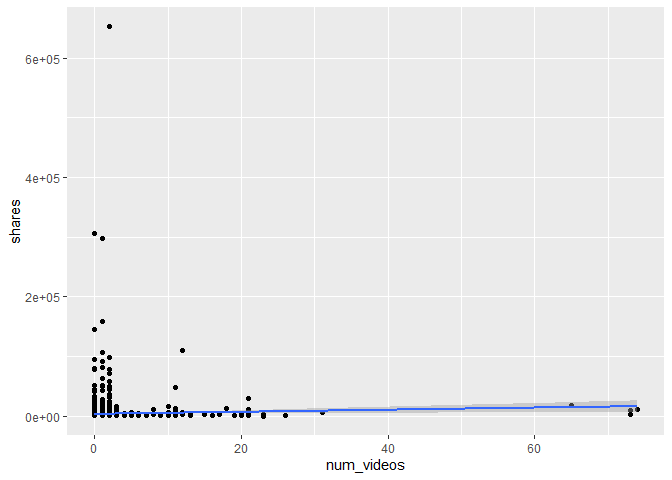

- Scatter plot of the number of videos and shares.

- Modeling

- Model Comparison and Selection

Introduction

The following is an analysis of online news popularity across a variety of channels. This analysis covers the following 6 data channels:

- Lifestyle

- Entertainment

- Business

- Social Media

- Tech

- World

The following report analyzes the # of shares of a particular piece of content as a function of a variety of variables, including;

- Number of Images in the Content (num_imgs)

- Number of Videos in the Content (num_videos)

- Week vs. Weekend Publications (is_weekend)

- Number of Words in the Content (n_tokens_content)

- Number of Words in the Title (n_tokens_titel)

- Polarity of the Content Title (abs_title_sentiment_polarity)

A few new variables were created, as well, which are described alongside the respective R Code.

As a part of our analysis, we modeled each of our predictive variables linearly, as well as via Random Forest and Boosted Tree Models. The various models were then compared against one another to select our final model, which was fit to our test data.

#Read in Libraries

library(tidyverse)

library(readr)

library(ggplot2)

library(randomForest)

library(shiny)

library(dplyr)

library(caret)

## Check Working Directory Path

getwd()

## [1] "C:/Users/Rebecca/OneDrive/Desktop/ST 558/Repos/Project2"

## Read in Raw Data Using Relative Path

rawData <- read_csv(file = "./project2_rawdata.csv")

rawData

## # A tibble: 39,644 x 61

## url timedelta n_tokens_title n_tokens_content n_unique_tokens

## <chr> <dbl> <dbl> <dbl> <dbl>

## 1 http://ma~ 731 12 219 0.664

## 2 http://ma~ 731 9 255 0.605

## 3 http://ma~ 731 9 211 0.575

## 4 http://ma~ 731 9 531 0.504

## 5 http://ma~ 731 13 1072 0.416

## 6 http://ma~ 731 10 370 0.560

## 7 http://ma~ 731 8 960 0.418

## 8 http://ma~ 731 12 989 0.434

## 9 http://ma~ 731 11 97 0.670

## 10 http://ma~ 731 10 231 0.636

## # ... with 39,634 more rows, and 56 more variables:

## # n_non_stop_words <dbl>, n_non_stop_unique_tokens <dbl>,

## # num_hrefs <dbl>, num_self_hrefs <dbl>, num_imgs <dbl>,

## # num_videos <dbl>, average_token_length <dbl>, num_keywords <dbl>,

## # data_channel_is_lifestyle <dbl>,

## # data_channel_is_entertainment <dbl>, data_channel_is_bus <dbl>,

## # data_channel_is_socmed <dbl>, data_channel_is_tech <dbl>, ...

## Create a New Variable to Data Channel

rawDataNew <- rawData %>% mutate(data_channel = if_else(data_channel_is_bus == 1, "Business",

if_else(data_channel_is_entertainment == 1, "Entertainment",

if_else(data_channel_is_lifestyle == 1, "Lifestyle",

if_else(data_channel_is_socmed == 1, "Social Media",

if_else(data_channel_is_tech == 1, "Tech", "World"))))))

## Subset Data for Respective Data Channel

subsetData <- rawDataNew %>% filter(data_channel == params$data_channel)

## Create Training and Test Data Sets

set.seed(500)

trainIndex <- createDataPartition(subsetData$shares, p = 0.7, list = FALSE)

trainData <- subsetData[trainIndex,]

testData <- subsetData[-trainIndex,]

trainData

## # A tibble: 4,382 x 62

## url timedelta n_tokens_title n_tokens_content n_unique_tokens

## <chr> <dbl> <dbl> <dbl> <dbl>

## 1 http://ma~ 731 9 211 0.575

## 2 http://ma~ 731 13 244 0.560

## 3 http://ma~ 731 8 708 0.482

## 4 http://ma~ 731 10 142 0.655

## 5 http://ma~ 730 13 306 0.535

## 6 http://ma~ 729 10 468 0.534

## 7 http://ma~ 729 6 164 0.588

## 8 http://ma~ 729 11 173 0.724

## 9 http://ma~ 729 9 330 0.502

## 10 http://ma~ 729 10 381 0.546

## # ... with 4,372 more rows, and 57 more variables:

## # n_non_stop_words <dbl>, n_non_stop_unique_tokens <dbl>,

## # num_hrefs <dbl>, num_self_hrefs <dbl>, num_imgs <dbl>,

## # num_videos <dbl>, average_token_length <dbl>, num_keywords <dbl>,

## # data_channel_is_lifestyle <dbl>,

## # data_channel_is_entertainment <dbl>, data_channel_is_bus <dbl>,

## # data_channel_is_socmed <dbl>, data_channel_is_tech <dbl>, ...

testData

## # A tibble: 1,876 x 62

## url timedelta n_tokens_title n_tokens_content n_unique_tokens

## <chr> <dbl> <dbl> <dbl> <dbl>

## 1 http://ma~ 731 9 255 0.605

## 2 http://ma~ 731 8 397 0.625

## 3 http://ma~ 731 11 723 0.491

## 4 http://ma~ 731 12 444 0.601

## 5 http://ma~ 731 6 109 0.667

## 6 http://ma~ 729 9 759 0.499

## 7 http://ma~ 729 9 233 0.553

## 8 http://ma~ 729 10 424 0.553

## 9 http://ma~ 728 10 347 0.517

## 10 http://ma~ 728 16 487 0.520

## # ... with 1,866 more rows, and 57 more variables:

## # n_non_stop_words <dbl>, n_non_stop_unique_tokens <dbl>,

## # num_hrefs <dbl>, num_self_hrefs <dbl>, num_imgs <dbl>,

## # num_videos <dbl>, average_token_length <dbl>, num_keywords <dbl>,

## # data_channel_is_lifestyle <dbl>,

## # data_channel_is_entertainment <dbl>, data_channel_is_bus <dbl>,

## # data_channel_is_socmed <dbl>, data_channel_is_tech <dbl>, ...

=======

Exploratory Data Analysis (EDA)

Create New Variables for EDA

#Create New Variable that Measures Title Length

trainData <- trainData %>% mutate(TitleLength = if_else(n_tokens_title <= 10, "Short Title",

if_else(n_tokens_title <= 15, "Medium Title", "Long Title")))

#Create New variable using weekday_is_() variables

trainDataNew <- trainData %>% mutate(day_of_the_week = if_else(weekday_is_monday == 1, "Monday",

if_else(weekday_is_tuesday == 1, "Tuesday",

if_else(weekday_is_wednesday == 1, "Wednesday",

if_else(weekday_is_thursday == 1, "Thursday",

if_else(weekday_is_friday == 1, "Friday",

if_else(weekday_is_saturday == 1, "Saturday", "Sunday"

)))))))

trainDataNew

## # A tibble: 4,382 x 64

## url timedelta n_tokens_title n_tokens_content n_unique_tokens

## <chr> <dbl> <dbl> <dbl> <dbl>

## 1 http://ma~ 731 9 211 0.575

## 2 http://ma~ 731 13 244 0.560

## 3 http://ma~ 731 8 708 0.482

## 4 http://ma~ 731 10 142 0.655

## 5 http://ma~ 730 13 306 0.535

## 6 http://ma~ 729 10 468 0.534

## 7 http://ma~ 729 6 164 0.588

## 8 http://ma~ 729 11 173 0.724

## 9 http://ma~ 729 9 330 0.502

## 10 http://ma~ 729 10 381 0.546

## # ... with 4,372 more rows, and 59 more variables:

## # n_non_stop_words <dbl>, n_non_stop_unique_tokens <dbl>,

## # num_hrefs <dbl>, num_self_hrefs <dbl>, num_imgs <dbl>,

## # num_videos <dbl>, average_token_length <dbl>, num_keywords <dbl>,

## # data_channel_is_lifestyle <dbl>,

## # data_channel_is_entertainment <dbl>, data_channel_is_bus <dbl>,

## # data_channel_is_socmed <dbl>, data_channel_is_tech <dbl>, ...

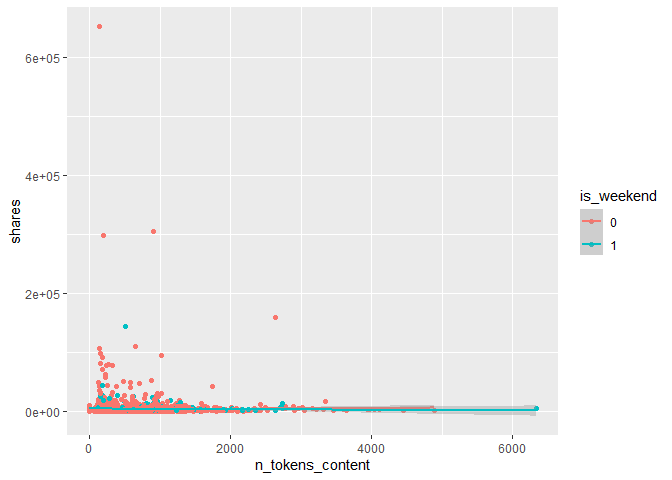

Graphical summary of shares by Content Length and Weekday vs. Weekend

#Convert is_weekend to a Factor

trainData$is_weekend <- factor(trainData$is_weekend)

#Table of Publications on Weekdays vs. Weekend

table(trainData$is_weekend)

##

## 0 1

## 3978 404

#Create a Scatter Plot of # of Words by Shares

g1 <- ggplot(trainData, aes(x = n_tokens_content, y = shares)) +

geom_point(aes(col = is_weekend)) +

geom_smooth(method = "lm", aes(col = is_weekend))

g1

We can inspect the trend of shares as a function of the number of words (tokens) in the content. If the points show an upward trend, then content with more words tends to be shared more often.If we see a negative trend then content with more words tends to be shared less often. The color-coding specifies if the content was published on a Weekday or Weekend.

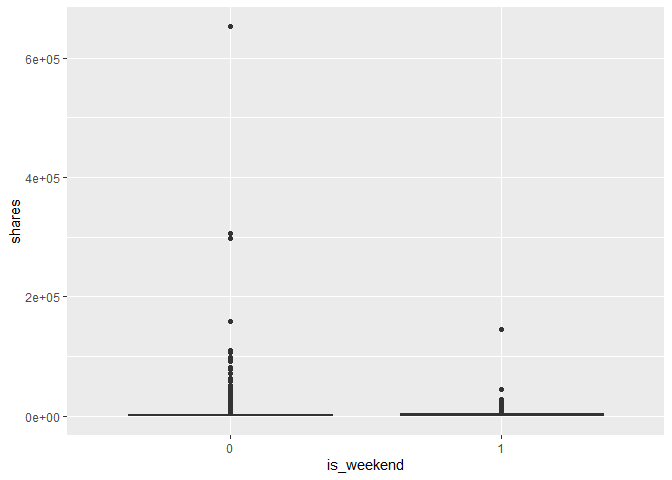

Graphical and Numerical summary of shares by Weekday vs. Weekend

#Create a Box Plot of Weekend vs. Weekday by Shares

g2 <- ggplot(trainData, aes(x = is_weekend, y = shares)) +

geom_boxplot()

g2

#Generate a Numerical Summary of Data Summarized in our Box Plot

trainData %>% group_by(is_weekend) %>% summarise(min = min(shares), med = median(shares), max = max(shares), mean = mean(shares))

## # A tibble: 2 x 5

## is_weekend min med max mean

## <fct> <dbl> <dbl> <dbl> <dbl>

## 1 0 1 1300 652900 2929.

## 2 1 150 2500 144400 4037.

We can inspect the trend of shares as a function of Weekday vs. Weekend Publications. The statistics show the Minimum, Maximum, Median, and Average # of Shares by Week (Published During the Week) vs. Weekend (Published During the Weekend)

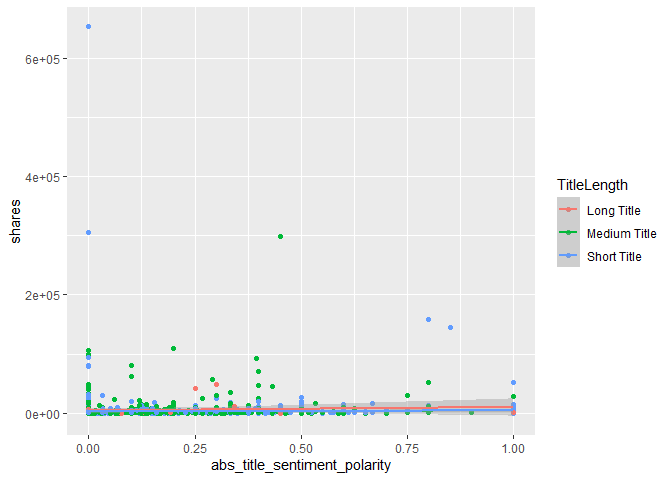

Graphical and Numerical summary of shares by Title Polarity and Length

table(trainData$n_tokens_title)

##

## 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19

## 3 5 33 101 260 533 688 784 757 567 346 187 84 25 6 2 1

# Create a Scatter Plot of Polarity of Title by Shares

g3 <- ggplot(trainData, aes(x = abs_title_sentiment_polarity, y = shares)) +

geom_point(aes(col = TitleLength)) +

geom_smooth(method = "lm", aes(col = TitleLength))

g3

## `geom_smooth()` using formula 'y ~ x'

# Numerical Correlation of Polarity of Title by Shares

cor(trainData$abs_title_sentiment_polarity, trainData$shares)

## [1] 0.02683986

We can inspect the trend of shares as a function of the polarity of the title of the content. If the points show an upward trend, then content with a more polarizing title (positive or negative) tends to be shared more often.If we see a negative trend then content with more a more polarizing title (positive or negative) tends to be shared less often. The color-coding specifies the length of the title. The correlation, shows us the numerical value of the correlation between our predictor variable(s) and response

Numerical summary of shares by day_of_the_week

#find mean, median, and standard deviation of shares by day_of_the_week

daySummary <-trainDataNew %>% group_by(day_of_the_week) %>% summarise(avg_shares = mean(shares), med_shares = median(shares), sd_shares = sd(shares))

#print out numerical summary

daySummary

## # A tibble: 7 x 4

## day_of_the_week avg_shares med_shares sd_shares

## <chr> <dbl> <dbl> <dbl>

## 1 Friday 2290. 1400 4361.

## 2 Monday 3649. 1400 23601.

## 3 Saturday 4904. 2700 11955.

## 4 Sunday 3462. 2200 4340.

## 5 Thursday 3174. 1300 15414.

## 6 Tuesday 2782. 1300 6923.

## 7 Wednesday 2593. 1300 8011.

In the summary plot you can see which days had the highest and lowest average shares, median shares, and look at the standard deviation to see which day had the largest range of shares.

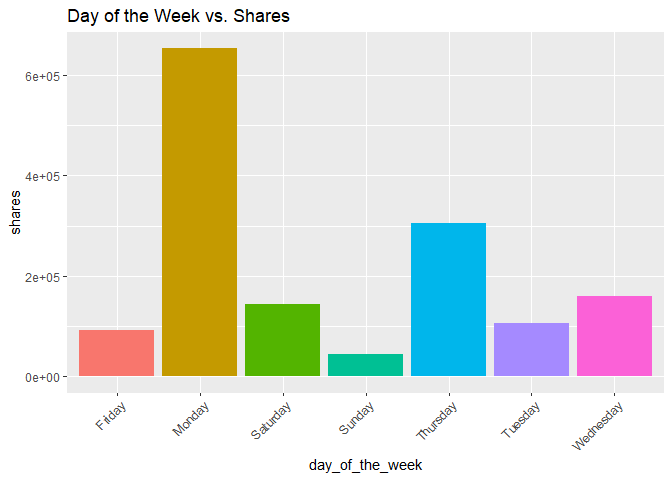

Bar chart of shares by day of the week

#create a basic plot with x and y variables

g5 <- ggplot(data = trainDataNew, aes(day_of_the_week, shares))

#make the plot a bar chart

g5 + geom_col(aes(fill = day_of_the_week), position = "dodge") +

#change the angle of the words to fit

guides(x = guide_axis(angle = 45)) +

labs(title = "Day of the Week vs. Shares") +

#get rid of legend

theme(legend.position = "none")

In this bar chart of day of the week vs. shares, you can see which days had the greatest total number of shares and which had the lowest.

Summary table of shares by number of images

#create summary table with different ranges of images

imagesSummary <- trainData %>% group_by(cut(num_imgs, c(min(num_imgs), 10, 20, 40, 60, 80, max(num_imgs)))) %>% summarise(avg_shares = mean(shares), med_shares = median(shares), sd_shares = sd(shares))

#rename column name

names(imagesSummary)[names(imagesSummary) == "cut(num_imgs, c(min(num_imgs), 10, 20, 40, 60, 80, max(num_imgs)))"] <- "image_number"

#print out numerical summary

imagesSummary

## # A tibble: 5 x 4

## image_number avg_shares med_shares sd_shares

## <fct> <dbl> <dbl> <dbl>

## 1 (0,10] 2431. 1400 5066.

## 2 (10,20] 6060. 2150 26533.

## 3 (20,40] 13860. 1500 58454.

## 4 (40,51] 1500 1500 NA

## 5 <NA> 5970. 1400 31139.

In the summary plot you can see if the amount of images affected the average, median, and standard deviation of shares.

Scatter plot of the image number and shares.

#create basic plot with x and y

g6 <- ggplot(trainData, aes(x = num_imgs, y = shares))

#make it a scatter plot with regression line

g6 + geom_point() +

geom_smooth(method = "lm")

## `geom_smooth()` using formula 'y ~ x'

In this scatter plot of the number of images vs. shares, you can see the relationship between the two variables. If it shows an upward trend, articles with more images tend to be shared more often. If the trend is negative, then articles with less images tend to be shared more.

Scatter plot of the number of videos and shares.

#create basic plot with x and y

g7 <- ggplot(trainData, aes(x = num_videos, y = shares))

#make it a scatter plot with regression line

g7 + geom_point() +

geom_smooth(method = "lm")

## `geom_smooth()` using formula 'y ~ x'

In this scatter plot of the number of videos vs. shares, you can see the relationship between the two variables. If it shows an upward trend, articles with more videos tend to be shared more often. If the trend is negative, then articles with less videos tend to be shared more.

Modeling

Linear Regression Models

A linear regression model allows for easy prediction of a response variable. It’s goal is to figure out which variables are significant predictors of the response variable and how do they impact it.

This Multiple Linear Regression Model looks at the # of Shares as a function of the # of Words in the Content AND whether or not the Content was published on a Weekend (0 = No, 1 = Yes)

## Convert is_weekend to Numeric

trainData$is_weekend <- as.numeric(trainData$is_weekend)

## Fit Multiple Linear Regression Model

fitLM1 <- train(shares ~ n_tokens_content + is_weekend, data = trainData, method = "lm", trControl = trainControl(method = "cv", number = 10))

fitLM1

## Linear Regression

##

## 4382 samples

## 2 predictor

##

## No pre-processing

## Resampling: Cross-Validated (10 fold)

## Summary of sample sizes: 3944, 3944, 3943, 3944, 3944, 3944, ...

## Resampling results:

##

## RMSE Rsquared MAE

## 10510.39 0.004757362 2669.599

##

## Tuning parameter 'intercept' was held constant at a value of TRUE

This Multiple Linear Regression Model looks at the # of Shares as a function of the # the Quadratic of Title Polarity Sentiment AND the Title Length (Short, Medium, Long)

## Fit Multiple Linear Regression Model

fitLM2 <- train(shares ~ abs_title_sentiment_polarity^2 + TitleLength, data = trainData, method = "lm", trControl = trainControl(method = "cv", number = 10))

fitLM2

## Linear Regression

##

## 4382 samples

## 2 predictor

##

## No pre-processing

## Resampling: Cross-Validated (10 fold)

## Summary of sample sizes: 3944, 3944, 3944, 3944, 3944, 3942, ...

## Resampling results:

##

## RMSE Rsquared MAE

## 10124.68 0.003578414 2712.194

##

## Tuning parameter 'intercept' was held constant at a value of TRUE

This multiple linear regression model looks at day of the week, number of images, and number of videos as predictors and shares as response.

#create fit using shares as response, day_of_the_week, num_imgs, and num_videos as the predictors

fitLM3 <- train(shares ~ day_of_the_week + num_imgs + num_videos, data = trainDataNew,

#method is linear model

method = "lm",

#center and scale the data

preProcess = c("center", "scale"),

#10 fold cross validation

trControl = trainControl(method = "cv", number = 10))

fitLM3

## Linear Regression

##

## 4382 samples

## 3 predictor

##

## Pre-processing: centered (8), scaled (8)

## Resampling: Cross-Validated (10 fold)

## Summary of sample sizes: 3944, 3945, 3944, 3943, 3943, 3944, ...

## Resampling results:

##

## RMSE Rsquared MAE

## 10488.95 0.01067003 2684.151

##

## Tuning parameter 'intercept' was held constant at a value of TRUE

Random Forest Model

Random forest modeling is a type of ensemble model that creates multiple trees from bootstrap samples without using all the predictors and a random subset of predictors for each sample. It then averages the results from the multiple trees.

#use train function

rfFit <- train(shares ~ day_of_the_week + num_imgs + num_videos + n_tokens_content, data = trainDataNew,

#use rf method

method = "rf",

#5 fold validation

trControl = trainControl(method = "cv", number = 5),

#consider values of mtry

tuneGrid = data.frame(mtry = 1:4))

rfFit

## Random Forest

##

## 4382 samples

## 4 predictor

##

## No pre-processing

## Resampling: Cross-Validated (5 fold)

## Summary of sample sizes: 3506, 3505, 3506, 3506, 3505

## Resampling results across tuning parameters:

##

## mtry RMSE Rsquared MAE

## 1 11891.42 0.010465408 2666.313

## 2 12144.40 0.007896754 2684.302

## 3 12429.05 0.007549101 2717.067

## 4 12775.22 0.006929914 2779.598

##

## RMSE was used to select the optimal model using the smallest value.

## The final value used for the model was mtry = 1.

Boosted Tree Model

Boosted modeling is a type of ensemble model that grows subsequent trees off of modified version of the original data. Any resulting predictions are updated as your Boosted Tree Model grows, based on criteria like the # of Subsequent Trees, Shrinkage Paramter, etc.

n.trees <- c(5, 10, 25, 100)

interaction.depth <- 1:4

shrinkage <- 0.1

n.minobsinnode <- 10

df <- expand.grid(n.trees = n.trees, interaction.depth = interaction.depth, shrinkage = shrinkage, n.minobsinnode = n.minobsinnode)

boostFit <- train(shares ~ abs_title_sentiment_polarity^2 + TitleLength, data = trainData, method = "gbm", trControl = trainControl(method = "cv", number = 5), tuneGrid = df)

boostFit$results

boostFit$bestTune

Model Comparison and Selection

#Add New Variables (Title Length and Day of the Week) to Test Data

testData <- testData %>% mutate(TitleLength = if_else(n_tokens_title <= 10, "Short Title",

if_else(n_tokens_title <= 15, "Medium Title", "Long Title")))

testData <- testData %>% mutate(day_of_the_week = if_else(weekday_is_monday == 1, "Monday",

if_else(weekday_is_tuesday == 1, "Tuesday",

if_else(weekday_is_wednesday == 1, "Wednesday",

if_else(weekday_is_thursday == 1, "Thursday",

if_else(weekday_is_friday == 1, "Friday",

if_else(weekday_is_saturday == 1, "Saturday", "Sunday"

)))))))

## Obtain RMSE on Test Data for Linear Models

predLM1 <- predict(fitLM1, newdata = testData)

postResample(predLM1, obs = testData$shares)

## RMSE Rsquared MAE

## 1.829744e+04 8.807110e-04 2.289314e+03

predLM2 <- predict(fitLM2, newdata = testData)

postResample(predLM2, obs = testData$shares)

## RMSE Rsquared MAE

## 1.828140e+04 2.050436e-05 2.810490e+03

predLM3 <- predict(fitLM3, newdata = testData)

postResample(predLM3, obs = testData$shares)

## RMSE Rsquared MAE

## 1.825641e+04 2.362166e-03 2.842232e+03

## Obtain RMSE on Test Data for Random Forest Model

predRF <- predict(rfFit, newdata = testData)

postResample(predRF, testData$shares)

## RMSE Rsquared MAE

## 1.817504e+04 1.821514e-02 2.791584e+03

## Obtain RMSE on Test Data for Boosted Fit Model

predBoost <- predict(boostFit, newdata = testData)

postResample(predBoost, testData$shares)

## RMSE Rsquared MAE

## 1.827863e+04 1.493896e-06 2.818807e+03